On Plus500 you have the option to trade with leverage. But what is leverage? And how do you adjust the leverage within the Plus500 software? In this article you will learn everything about trading with leverage.

What is leverage?

When you start trading, you have the option to apply leverage. A lever makes it possible to open a larger position with a smaller amount. A lever is always displayed as a ratio number. For example, the leverage on the raw material oil can be 1:10.

But what does leverage mean in practice? When the leverage is 1:10, you can open a position of $1000 with an amount of $100. By using leverage, you can open larger trading positions with a smaller amount of money.

How can you use leverage?

With Plus500 you can apply leverage to all CFDs. But how is leverage used in trading?

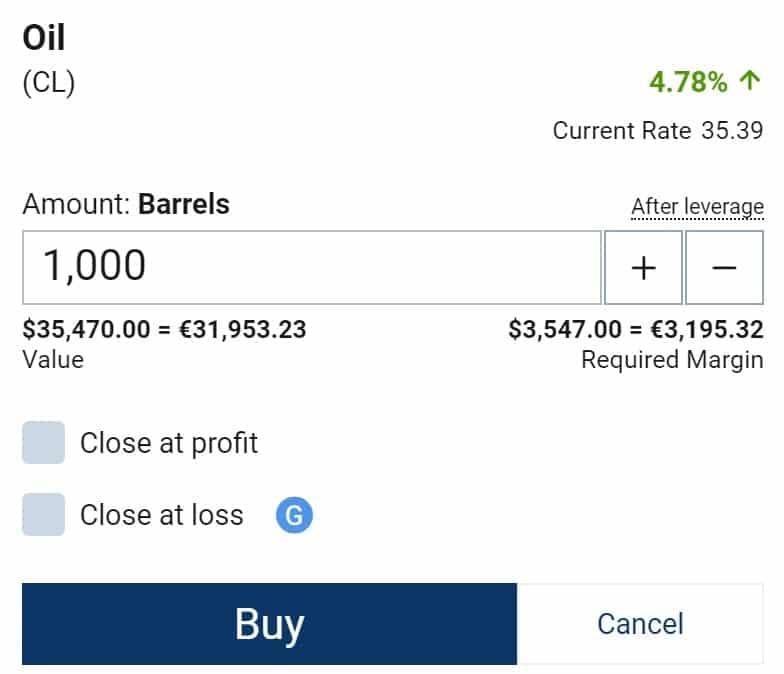

When you use leverage, you trade with more money than you have deposited in your account. When you open a trading position at Plus500, you can set the leverage you want to apply.

Illustrative prices.

In the example above you can see that we open a position with a value of $391,685.35. The required margin of $39,168.56 indicates how much money you need to open the position. The leverage in this case is 1:10. So when you open the trade, the value of the position is ten times higher than the amount you put in.

How does leverage work in practice?

What does leverage do to the potential profit and potential loss you can achieve with a trade? If you buy or sell $100 worth of shares you would get the following results:

- Will the share increase by $10? Then you make a 10% profit.

- Does the share decrease by $10? Then you make a 10% loss.

Leverage ensures that both your losses and profits can increase faster. If you had applied 1:10 leverage to the above trade, results would be as follows:

- Will the share increase by $10? Then you make 100% profit.

- Will the share decrease by $100? Then you make a 100% loss.

As you can see both your profits and losses can accumulate quickly when you apply leverage. It’s therefore important that you carefully monitor the risks of your trades.

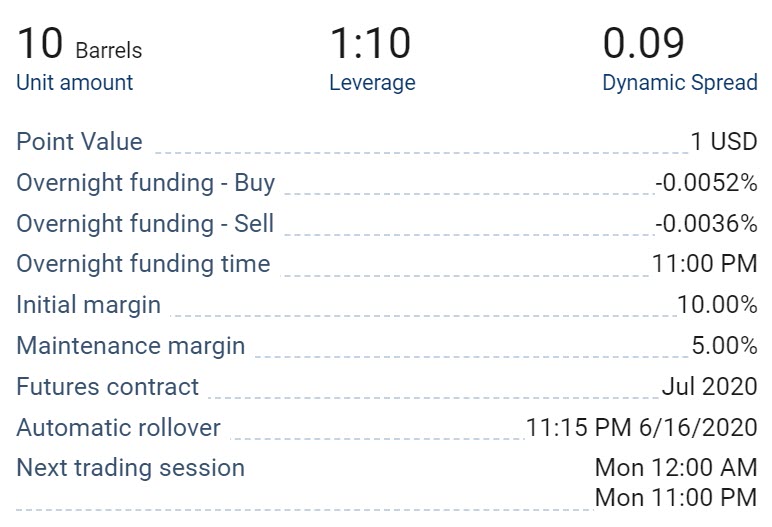

Take care of your margin

When you trade with a leverage, it is important to keep an eye on your margin. When you open a trading position with leverage, the broker finances a big percentage of the position. To keep your position open, you need to keep a close eye on the required margin. With each CFD you can find directly under info which margin should be present on your account.

Illustrative prices.

If the maintenance margin is 5%, you should always have 5% of the total value of your trade in your account. If you invest $100 with a leverage of 1:10, your total position is worth $1000. With a maintenance margin of 5%, you must always have at least $50 in your account to keep your position open.

Is there not enough money in your account? Then you have to deposit extra money. If you do not do this you will have to deal with a margin call. Your position will then be closed immediately and you may lose the entire amount of your trading account. It is therefore important to be careful with leveraged trades!

How much does leverage trading cost?

There are some costs involved when you start trading with a leverage on Plus500. You can always examine the costs of a CFD within the software.

Illustrative prices.

You pay a spread on every trade. The spread is the difference between the buy and sell price of a CFD. The spread can differ per CFD and per trading period.

When you trade with a leverage, the broker must finance part of the money of your trade. You pay a so called overnight funding amount, which is either added or subtracted from your account when holding a position after a certain time (the Overnight Funding Time). The overnight funding time and the daily overnight funding percentage can be found in the details link next to the instrument’s name on the main screen of the platform.

Conclusion about trading with leverage

Trading with leverage can be interesting for the active trader. With a leverage you can open a larger trade with a lower amount of money.

However, you should also be careful with leverage. When the CFD falls by a few percent, you can lose your entire investment. It is therefore important to only trade with leverage when you have sufficient experience!