With Plus500 you always trade through derivatives. You can therefore experience a rollover with different securities. You trade raw materials such as oil by buying and selling futures. Futures expire every month and your position would close automatically. This does not happen thanks to the automatic rollover with Plus500. In this article you can read how this works.

What is a rollover?

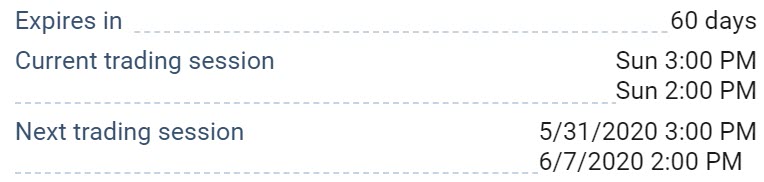

On Plus500 you can see for each effect whether there is an expiry date. An expiration date indicates that the contract will be automatically closed on that day.

For most effects, Plus500 will automatically apply a rollover to the position. This means that the next contract will be bought immediately.

![]()

Here you can find a video with more information about this topic:

Example of an automatic rollover

Commodities are traded through monthly contracts. These contracts expire on the expiry date. Plus500 will then apply an automatic rollover.

The new CFD can be more or less expensive than your current CFD. The difference will be settled with your account. Let’s explain this using a fictitious CFD oil position.

The first possibility is that the new contract is more expensive. In this example, your current CFD costs $40 and the new CFD costs $50. Your $40 position will then be closed and the $50 position will be opened. This has the following consequences:

- On a buy position, there will be a negative adjustment of $10.

- On a sell position (short) there will be a positive adjustment of $10.

On balance, therefore, nothing changes and you can continue to speculate on the price changes. Of course, it can also happen that the new contract is cheaper. Your current CFD costs $50 in this example, and the new CFD costs $40. Your $50 position will then be closed automatically and the $40 position will be opened. This has the following consequences:

- On a buy position there will be a positive adjustment of $10

- On a sell position there will be a negative adjustment of $10

Also in this case nothing will change on balance. The automatic rollover therefore has no impact on your trading activity. Orders such as the stop loss are also automatically adjusted to the new situation.

Example in practice

Let’s say you buy 100 contracts in the UK100. The automatic rollover will take place on January 19 at noon. The current purchase price of the index is 10,000. The price of the new contract is 10,100 and is therefore $100 more.

On a buy position, the difference is subtracted from your position. Your position will then be worth $100 more, but $100 will be deducted from your position. If you just went short on the UK100, $100 will be added to your position. Your position is worth $100 less, but because $100 is added it makes no difference.

What are the advantages of an automatic rollover?

Without an automatic rollover you would have to reopen the position yourself after it has been closed. You should be ready at just the right time so you don’t miss out on some of the price developments. Thanks to an automatic rollover, you don’t have to worry about this.

Another advantage of the automatic rollover is the lower cost. You do not pay the spread again to open a new position. Automatically rolling through your positions is completely free at Plus500.

Do all securities have a rollover?

Not all securities expire. shares, for example, have no expiry date. The rollover does therefore not apply to CFDs on shares.

Some securities have an expiration date, but no automatic rollover. An example of this are the crypto coins (availability subject to regulation). Therefore, you have to be extra careful when you trade in cryptocurrencies through Plus500. If you want to speculate over a longer period in a CFD with an expiry date but without automatic rollover, you have to manually open the position again.

Illustrative information.