With Plus500 you can actively trade in shares by using CFDs. In this article you will read everything you need to know for buying and selling CFD shares with the Plus500 platform. All your pressing questions are answered in this comprehensive guide.

How can you trade in shares with Plus500?

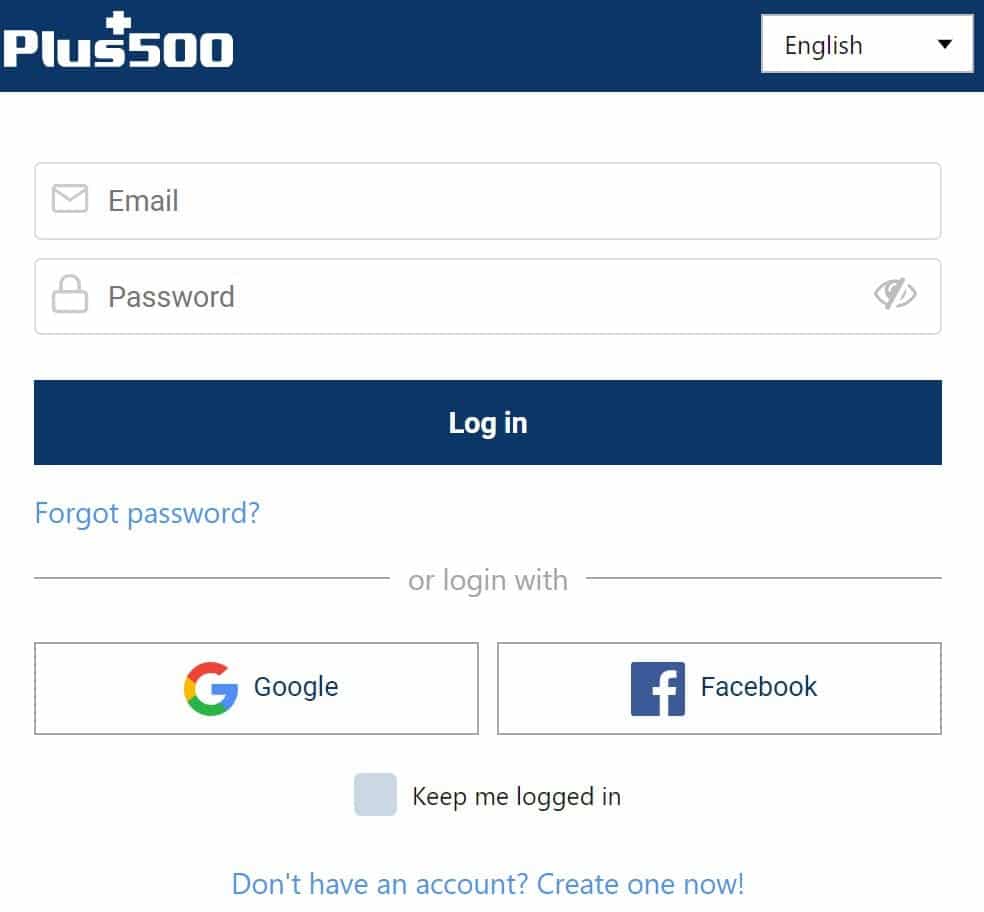

With Plus500 you trade in shares by using CFDs. You do not buy and sell shares in the traditional way. With Plus500 you never become the owner of the share. With a CFD, you only trade in the price trend of the share. Before you can trade in the prices of shares with Plus500, you need to open an account.

You can open a free demo account at Plus500 with which you can practice buying and selling CFD shares. You can use the button below to open an account directly:

[button title=”Plus500 register” size=”large” nofollow=”1″ url=”/go/plus5002″ target=”_blank”]

In order to open a demo account, you only need to have an email address and choose a password. With this information you can then trade with a virtual amount of money in all known shares.

How do you buy a CFD share on Plus500?

Plus500’s software is very user-friendly, so you can quickly find the shares you want to trade. All shares are classified by country. It is also possible to view the most popular stocks. The most popular stocks are those that are in the news a lot and therefore attract a lot of trading activity. You can also see which shares have risen and fell the most.

Once you have found a share you want to trade in, you only need to press the buy button. After you press the buy button you will see the order screen below:

Illustrative prices.

In the order screen you can enter the number of shares you want to open a position on. The minimum amount you can invest in varies per share. After you fill in the amount of CFD shares you want to buy, you see the amount of money you need to open the position.

In some cases, it can be interesting to automatically open or close the position at a certain price. You can achieve this by using orders. When you use orders, you can automate part of your trading activities.

How do you sell a CFD share on Plus500?

After you have opened a position, you can see it under open positions. Here you can manage all your current share trades. It is possible to set a price at which you automatically take your profit or loss. You can also close your position here.

Your current profit or loss is not final until you close the position. It may happen that your position is first $100 in the minus, but then gains $200 in the plus. Therefore, always consider your plan in advance and close the position when your investment has reached your goal.

When you close the position, your CFD stock position will automatically be sold. Note that you can only close positions when the market is open. Every market has fixed opening hours at which you can trade the share. The stock exchanges are closed on weekends.

![]()

Illustrative prices.

How do you short sell a share?

At Plus500 it’s also possible to short sell a share. When you short a share, you can speculate on decreasing share prices. In order to use this functionality, you have to press the sell button within the software.

When you short a share, you achieve a positive result with a falling price and a negative result with a rising price. With a short position you can use the same options as with a buy position.

Using orders on a share

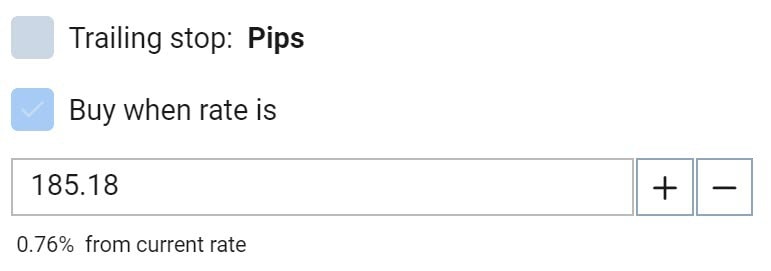

It can be interesting to use orders when trading in CFD shares at Plus500. You can easily place an order within the order screen. You do this by using the option buy when rate is.

Illustrative information.

When you open the position, you can find it in the open orders screen. You can delete or change your order here at any time. By using orders, you can also open transactions when you are offline.

Can you trade in penny stocks with Plus500?

Obviously, this principle works both ways: your losses can also increase faster with a penny stock. Trading in penny stocks is therefore especially attractive to more speculative investors. If you want to invest in penny stocks, you will have to select another broker since Plus500 does not offer them.

Finding the shares

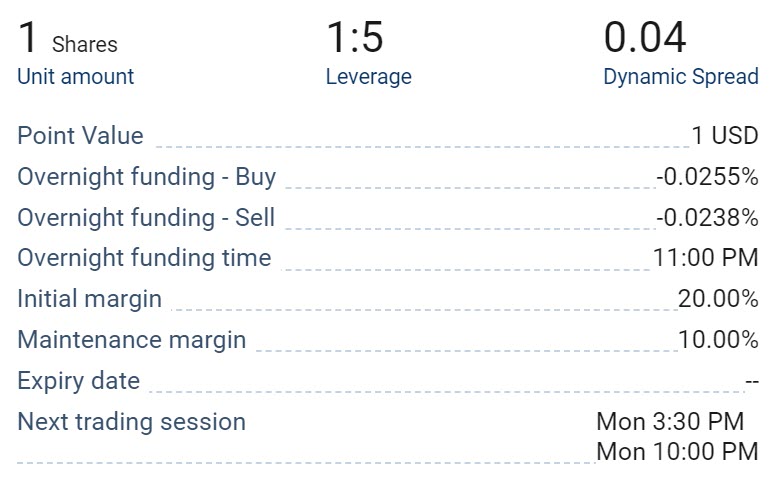

Trading on Plus500 is not free. You pay costs for every share transaction you make. However, the costs you pay are not fixed. With many brokers you pay e.g. a few dollars as a fixed commission on each trade. This greatly reduces your return when you trade with small amounts. Fortunately, the transaction costs on Plus500 are always relative to the amount you trade with.

At Plus500 the transaction costs are formed by a spread. The spread is the difference between the buy and sell price. When the spread is a cent per share, you pay a cent in costs for every share you buy. As a result, it makes little difference whether you buy one share or a hundred: the relative transaction costs remain the same.

We checked Plus500 and discovered that you can trade against attractive fees in all foreign CFD shares. This is interesting, since investing in foreign shares with a traditional broker can be very expensive. If you are looking for a low priced share at Plus500, you can compare the costs of the different CFD shares you can trade in with Plus500.

Illustrative information.

What happens to dividend on Plus500?

Companies can decide to pay out dividends. Dividend is a profit sharing. When the company makes a million profit, it may decide to pay out half of that. When 500,000 shares are outstanding, each shareholder will receive $1. The payment of the dividend influences the stock price.

Before the dividend was paid, there was $500,000 in the company’s cash account. This amount has now been spent and the value of the company therefore falls by $500,000. The share price will fall by $1 after the dividend is paid. Plus500 corrects your positions when dividend is paid.

When you have bought a CFD share position, the following happens:

- The price of your share drops by $1.

- You will receive $1 in dividend settlement.

When you have sold a CFD share position, the following happens:

- Due to the drop of $1, you achieve $1

- You pay $1 in dividend.

Therefore, paying a dividend has no effect on the value of your share position at Plus500.

What is a share?

Before trading in shares, it’s important that you understand what shares are. When a company wants to raise money, it can decide to issue shares. When you buy a share, you become a co-owner of the company.

Shares of large companies are owned by millions of people. They can jointly vote on the company’s policy through the shareholders’ meeting. They can also at any time decide to sell their share through the stock exchange.

The price of a share is determined by the game of supply and demand. When people sell a stock en masse, the price drops. When people really want to have a share, the price rises.

When trading shares, it is therefore important to estimate how people will respond to news items. The price of a share does not reflect the actual value of a company. The price only shows how much confidence investors have in the future of the company.

What should you pay attention to?

When you start trading shares, it is important to pay close attention to the risks. You can easily lose your entire deposit with your share trading activities. It is therefore important to trade with a plan.

A good investment plan dictates when you buy a stock and when you sell it again. Think about this before you open a position. By doing so you can prevent yourself from losing money under the influence of emotions.

Do you want to get better at trading shares? Then it can be smart to open a free demo account at Plus500. With a demo the market is simulated one on one and you can try out different strategies.