When you start trading on Plus500 you can both open a long and a short position. By short selling you place an order on a decreasing price. When the price drops you achieve a positive result. When the price goes up, you lose money. In this article we look at how you can short sell with Plus500.

How to speculate on falling stock prices?

Plus500 gives you two options when you start trading:

- Buy: you then place a stock market order on a rising price

- Sell: you then place a stock market order on a falling price

With the sell button you can speculate on a decrease of the price of a CFD.

illustrative prices.

After you have opened a position, the results are automatically tracked under open positions. When the price falls you achieve a positive return. When the price rises you achieve a negative return. Only after you close the position your profit or loss will become definitive.

What are the costs of short selling?

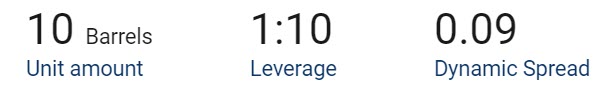

Once you’ve placed an order, you pay a so-called spread. The spread are fixed transaction costs. The spread is indicated for each CFD share within the Plus500 software.

illustrative information.

If you leave a position open for a longer period, you often pay financing costs. The premium that you pay daily for short positions is indicated as overnight funding – Sell. On some securities you receive a daily premium. If this is the case, there is a positive number displayed instead of a negative number.

[alert title=”Our tip: do you want to know more about the costs at Plus500? Then read this article!” color=”blue” url=”/costs” target=””]

How does short selling work?

When you go short on a share you sell the share without actually owning it.

With Plus500 you do not actually own any shares, since you trade in CFD’s. With a CFD’s. it is still possible to open a short position. When you open a short or sell position you profit when the buy rate of the instrument falls below its opening sell rate. Vice versa , if the buy rate rises above the opening sell rate, the sell position will be in loss.

A buy position is a position that profits, when the sell rate of the instrument increases above its opening, buy rate. Vice versa, If the sell rate falls below the opening buy rate, the buy position will be in loss.

The calculation of a position’s profit/loss (P/L) is as follows:

– In case of a buy position: (Close ‘sell’ rate – Open ‘buy’ rate) X amount of contracts

– In case of a sell position: (Open ‘sell’ rate – Close ‘buy’ rate) X amount of contracts”

Deposit enough money

You must always cover your trading position. You do this by depositing sufficient money in your trading account. It is important that you also have enough money in your account during your trade. You can learn why this is important in our article about trading on margin.

If the price drops you can buy back the CFD share at a lower price. You sold the stock at a higher price before. The difference between the moment you open the short position and the moment you close the position is your ultimate return. All these different steps are completely automated at Plus500. When you short sell with Plus500, you don’t have to make difficult calculations in between. Speculating on a declining course is 100% user-friendly with Plus500.

What are advantages and disadvantages of short selling

The biggest advantage of being able to speculate on a declining stock price is that you have more flexibility. When you can only buy, you can only place an order on a rising price. In bad times, the prices of shares can fall quickly. By having the option to open a short position you can benefit from all types of market conditions.

A major disadvantage and risk of going short is that your potential loss is unlimited. The price of a share will not fall further than zero. In theory a share can continue to rise indefinitely. Your losses can therefore increase considerably with a short position. Professional investors may even lose more than their entire investment.

Fortunately, on Plus500 you are protected against a negative balance. On Plus500 it is therefore not possible to lose more than the balance in your account. However, it is still wise to use a stop loss. With a stop loss you can limit the maximum loss on your position.

When do traders go short?

It can be very interesting to short sell during an economic crisis. Prices can drop considerably in cases of panic. It can also be interesting to speculate on a downward trend when very negative news comes out. The emissions scandal at Volkswagen, for example, caused a significant drop in the share price.