Before trading with Plus500, it is important that you understand how the fees are calculated. You don’t pay fixed commissions on your trading activities. However, the company charges for various services. In this article you will discover how Plus500 charges costs for your trading activities.

A demo account is 100% free

A big advantage of Plus500 is the fact that the demo is 100% free. We investigated whether there are hidden conditions and this is not the case. You can try the options 100% for free with the demo. By using a demo you can immediately discover how the costs are calculated on a transaction. Use the button below to directly open a free demo account with Plus500:

[button title=”Plus500 register” size=”large” nofollow=”1″ url=”/go/plus5004″ target=”_blank”]

What are the trading fees on Plus500?

On Plus500 you pay costs on your trades. In this section we discuss all the different trading costs that are charged by Plus500.

No commissions

At Plus500 you do not pay commissions over all your trades. However, this does not mean that trading with Plus500 is completely free. Still, it is a great advantage not to have to pay commissions on your trades. With many brokers you pay a fixed amount on every transaction. This can make it unattractive to trade with small amounts. Since the costs at Plus500 are not fixed, this broker is also fit for trading with smaller amounts of money. All transaction fees you pay are relative to the size of the position you open.

What is the spread?

At Plus500 you pay a spread over every transaction. The spread is the difference between the buy and sell price. Sometimes you can e.g. buy a share for $10 and sell for $9,98. The 2 cents are then the transaction costs per CFD share. When you open a position, it always starts with a small loss.

There are different types of spreads on Plus500:

- Dynamic spread: This spread changes constantly. The spread fee depends on market developments

- Not fully dynamic spreads: This spread is often a set amount per traded unit under normal market conditions. However, when the markets are especially volatile or illiquid the spread can still be dynamic.

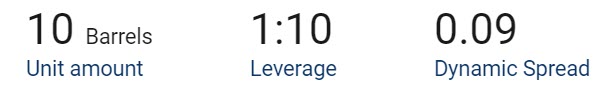

Note that when you apply leverage, the transaction costs also increase. A leverage ensures that you can take a larger position with a smaller amount. By using leverage, you can trade with $1,000 in $10,000 of CFD oil barrels. When you apply a leverage of 1:10 you trade in ten times as many barrels. In this case, you also pay ten times as much spread.

Illustrative prices.

Foreign Currency conversion fee

With Plus500 you regularly trade in foreign currencies. For example, US shares are traded in dollars and European shares in euros. If you have a Euro account, the amount on your account must first be converted into dollars before you can buy the shares. This normally costs extra money, so it is wise to take a look at the exchange costs.

When trading in foreign currencies, it is important to take this into account. You also run a foreign exchange risk with investments in foreign currencies. When you own a Euro account and trade in a dollar-denominated share, the Euro may lose value against the dollar. This makes it possible to achieve a negative result with your investment even with a rising share price.

Inactivity fee

If you do not log into your trading account for three months, an inactivity fee will be charged. The inactivity fee is $ 10 a month. From the moment the costs are calculated, you pay this fee every month, but only on accounts with real money. You can also not have a negative balance.

To avoid losing money, it’s therefore important to log into your account regularly.

Guaranteed stop-order

You can choose to use a guaranteed stop order. A stop order ensures that your position is automatically closed when it reaches a predetermined loss. That way you can avoid losing the full amount in your account due to one bad trade. You do pay extra costs for using a guaranteed stop-loss.

When you select the guaranteed stop-loss you’ll see that the fee for the spread increase. Plus500 charges additional costs for a guaranteed stop-loss, because there is a risk that the stop-loss you set cannot be performed at the market price. This can happen when there are strong market movements. When you use a guaranteed stop order, this risk is with the broker and you will not lose more than the amount you set.

What are the rollover costs?

On Plus500 you pay no extra costs for using a rollover. This is fully automatic with many CFDs. You can read more about this in the article about the rollover.

Withdrawing money

At Plus500 you do not pay any extra for withdrawing money. You can withdraw the amount in your trading account for free (maximum 5 times), after that charges apply). You can read more about this in the article about withdrawing money.

What is the holding fee?

On Plus500 you don’t pay a holding fee. This means that you do not have to pay any extra fees over the amount you deposit on your trading account.

Is trading beneficial at Plus500?

Plus500 is a relatively beneficial party for trading CFDs. Spreads are very reasonable compared to other CFD brokers such as eToro and IG Markets. Plus500 is therefore suitable for short-term speculation.

It’s important to keep in mind that Plus500 is not suitable for long-term investments. You also have to be careful with the lever: the leverage can ensure that you pay higher transaction fees.