Bitcoin trading at Plus500

Do you want to trade bitcoin? Then you’ve come to the right place! We discuss how you can actively trade bitcoin CFDs with Plus500. By using Plus500 you can speculate on both increases and decreases of the bitcoin price. But how does trading in Bitcoins with Plus500 work? (Instrument availability subject to regulations).

Bitcoin trading with Plus500

Before you can trade bitcoins with Plus500, you must first open an account. At Plus500 you can trade in the price movements of the bitcoin without paying commissions. Because you can also open a short position, you can open a position on a falling crypto market. Finally, you have the option to apply a leverage which allows you to open a larger position with a smaller amount.

Do you want to try the possibilities on Plus500 completely free with a demo account? Then use the button below to directly open an account with Plus500:

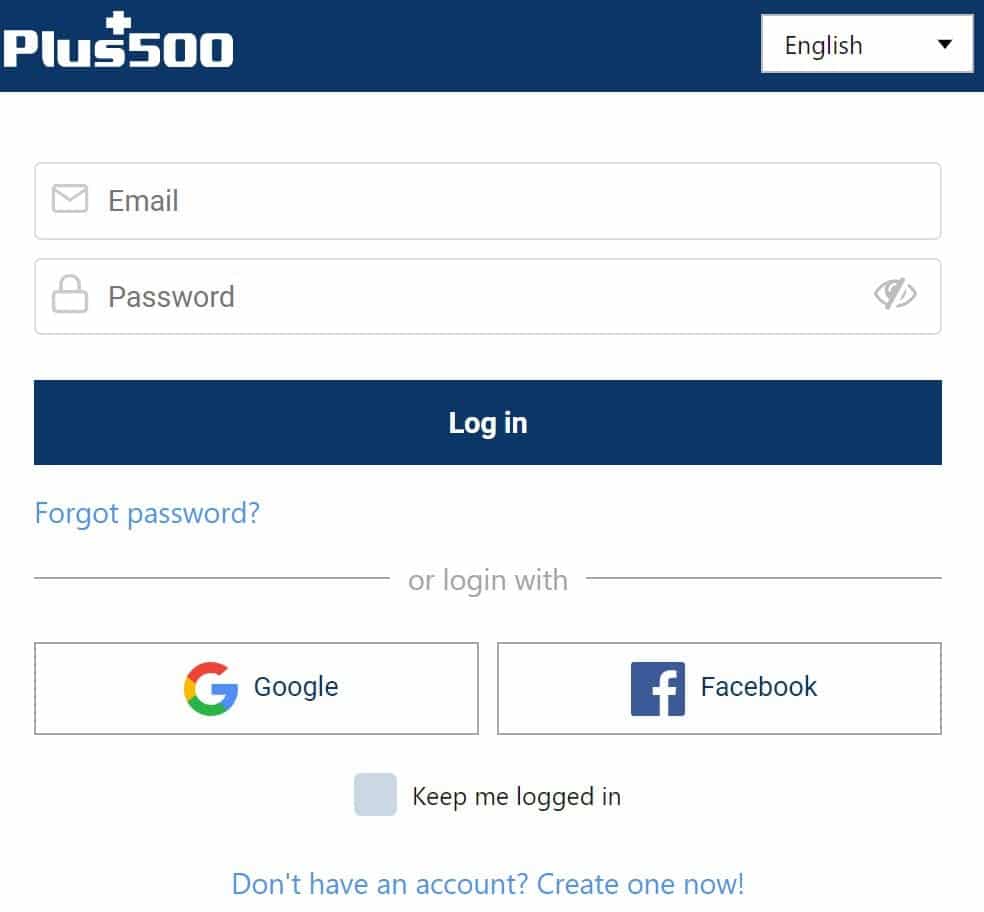

On the website you only have to leave an email address and password to use the online WebTrader directly.

If you want to start trading bitcoin CFDs with real money, you must first leave some more data. Plus500 is an online trading platform, and they are required by law to confirm your identity first.

How does bitcoin trading work with Plus500?

Normally, you need a wallet when you buy bitcoins. A digital wallet is a way to store crypto coins securely. A major disadvantage of the wallet is that it can be hacked. In the past, it has happened regularly that smart hackers have stolen large amounts of bitcoins.

Fortunately, on Plus500 you do not trade with a wallet in bitcoins. On Plus500 you never even directly buy Bitcoin. With Plus500 you trade in the price trend of the bitcoin by using CFDs. CFD stands for contract for difference and this is a type of derivative with which you can speculate on price increases and price drops of the Bitcoin.

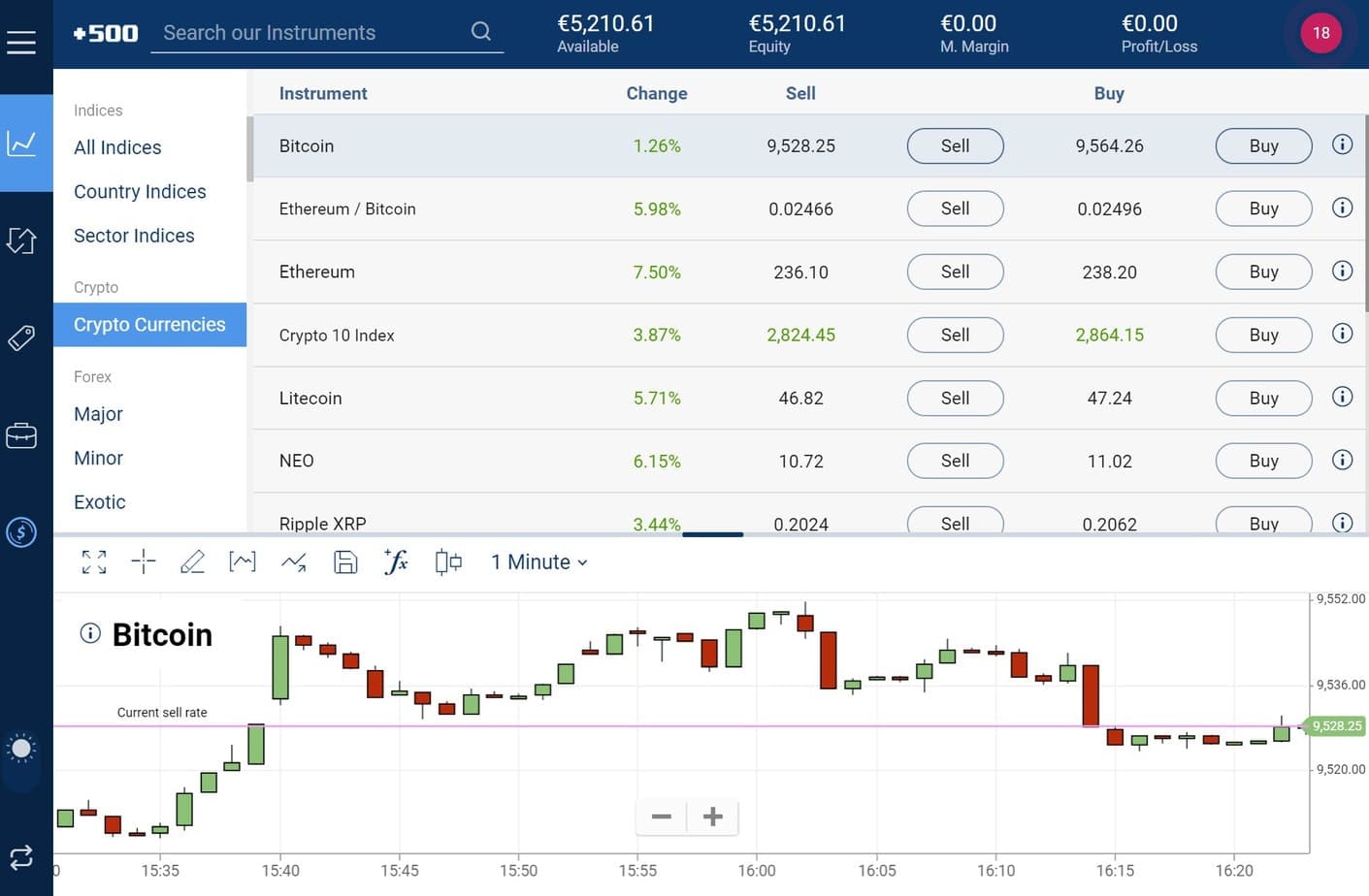

In our Bitcoin Plus500 tutorial we show how you can open a trading position within the platform of Plus500. After you are logged in on Plus500 you can navigate to the cryptocurrency category within the platform.

Illustrative prices.

Find the Bitcoin CFD within the software. When you press the Bitcoin CFD you have two options:

- To buy: you then speculate on an increasing price.

- To sell: you then speculate on a decreasing price.

It is important to remember that you have a high risk of losing money rapidly due to leverage. When you press one of the two buttons, the Bitcoin order screen opens. Below you can see what this looks like:

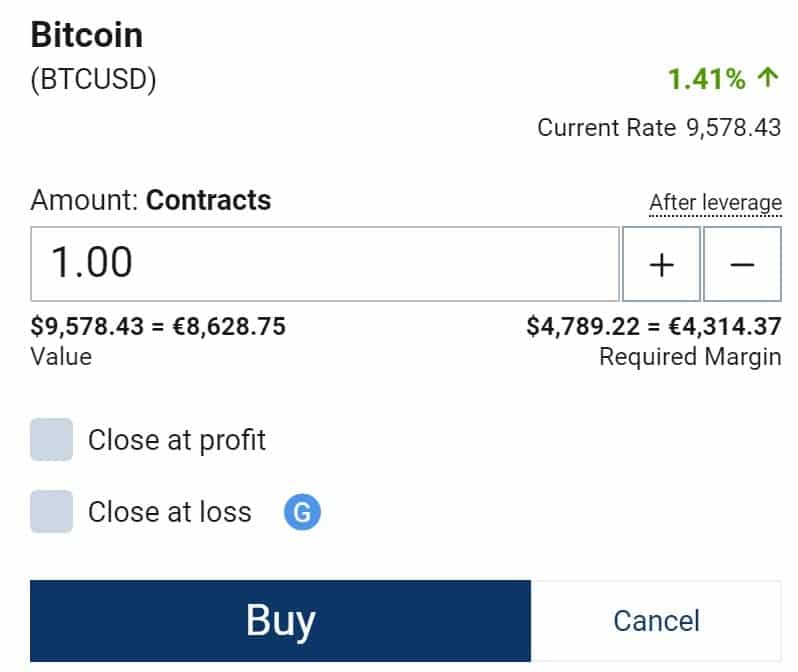

Illustrative prices.

In this screen you can enter the details of the position in the Bitcoin CFD. First you have to determine how many Bitcoins you want to trade. On Plus500 it’s possible to trade in 1/50th bitcoin. This also allows you to speculate on bitcoin’s price changes with smaller amounts of money. You can also enter whether you automatically want to take your loss or profit at a certain price. By setting these values you can automate the trading activities in Bitcoin as much as possible.

Illustrative prices.

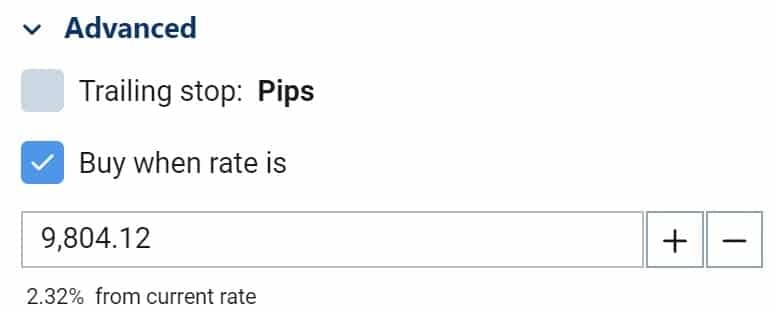

It is also possible to place an order on the bitcoin. You do this by setting a value at which you automatically buy Bitcoin CFDs. By using orders, you can respond to market developments without having to be physically behind your computer.

You should know this before trading bitcoin

Before trading bitcoin CFDs on Plus500, you must understand the following elements:

Leverage trading

You can use a leverage on Plus500. On cryptocurrencies such as Bitcoin, the maximum leverage is one to two. This means that with an amount of $1000 you can take a position of $2000. In practice, using leverage makes both your potential gains and your potential losses accumulate twice as fast.

With leverage you can therefore take extra advantage of small price changes. It’s important to pay close attention when you use leverage. You can lose your entire deposit faster when you use leverage. When the price of the bitcoin drops 50% you lose 100% of the value on your account. You can read in detail how this works in the article on leverage trading.

Bitcoin expired contracts

It is also important to remember that you do not invest directly in Bitcoin. On Plus500 you trade in a price contract on the Bitcoin. The CFDs on the Bitcoin therefore expire every 60 days. When the contract expires, your position on the Bitcoin will be closed automatically. This means that your open profit or loss becomes final.

You can respond to this by opening a new Bitcoin position. You do pay the transaction costs every time you open a position again. It’s therefore important to pay close attention to the expiration date of the Bitcoin. When the Bitcoin contract expires in a few hours, it is probably better to wait a while before opening a trade on the digital currency. When you open a new transaction, you pay the transaction costs again.

Shorting Bitcoin

At Plus500 you have the option to short sell the Bitcoin. This is advantageous: by shorting the Bitcoin, you can speculate on a fall in the Bitcoin price. The Bitcoin is a very volatile currency that can drop and rise several percent multiple times a day. Because you can place orders in both falling and rising markets, you can make a trade within any market situation.

How much does trading Bitcoins with Plus500 cost?

At Plus500 you do not pay fixed commissions on your investments in CFD Bitcoins. This is advantageous: it makes it possible to trade actively in the price movements of the Bitcoin with smaller amounts of money. However, trading in Bitcoins at Plus500 is not completely free. There are two ways in which Plus500 charges costs for your trading activities.

The first way is by calculating a spread. The spread is the difference between the buy and sell price of a Bitcoin. Under the button Information you can immediately see which spread you pay for each Bitcoin transaction. This amount may change when market conditions change. It is therefore always wise to look at the spread before opening a position.

Illustrative prices.

The second way Plus500 makes money from your Bitcoin trades is by charging financing costs. When trading CFDs, you have the option to trade with leverage. Plus500 then finances a large part of your trade. You pay a daily amount of interest on this amount. You only pay the financing interest on the Bitcoin if you leave the position open for several days.

Illustrative prices.

What is Bitcoin?

Bitcoin is a digital currency with some unique features. The Bitcoin is not controlled by a central party. Normal currencies are always controlled by a central party. For example, the euro and the dollar are regulated by central banks and governments have a lot of oversight over all transactions performed.

This is not the case with Bitcoins. Transactions executed with the Bitcoin are more anonymous than transactions executed with for example, the euro or dollar. This makes the coin very popular among people who value their privacy.

However, the value of Bitcoin has not yet been proven. The cryptocurrency is rarely used for payments in shops or restaurants. Most of the value of Bitcoin is therefore created by trust. Investors are confident in the underlying concept of Bitcoin and the price has risen considerably.

The cryptocurrency is rarely used for payments in shops, for example. Most of the value of Bitcoin is therefore created by trust. Investors are confident in the underlying concept of Bitcoin and the price has therefore risen considerably.

How is the price of Bitcoin affected?

So far, banks and investment funds are staying away from Bitcoin. It is mainly speculators and cryptocurrency enthusiasts who trade in Bitcoin. This makes the price trend of the Bitcoin erratic. The price can easily rise or fall several percent in one day.

When trading in Bitcoin, it may be wise to pay close attention to the sentiment. Because the market is dominated by private investors, the price can collapse or rise sharply with certain news items. Therefore, when trading Bitcoin, constantly keep an eye on the opinion of the average Bitcoin investor.

Trading Ethereum and other crypto coins

With Plus500 you can also trade in other known cryptocurrencies. It’s also possible to take positions with CFDs on, for example, Ethereum. It may be wise to spread your trades over multiple crypto coins. After all, it is not yet certain whether one cryptocurrency will become the dominant currency.

You can do this on Plus500 by opening multiple CFD positions on different crypto coins or you can choose to trade in a crypto fund. A crypto fund consists of a basket with different crypto coins.

Consider the risks

When you start trading bitcoin with Plus500, it’s important that you understand the risks. When trading bitcoin, you have a high risk of losing your entire investment. It is therefore important to speculate only on the Bitcoin with money that you can miss.

The Bitcoin is very volatile and using leverage further increases the chances of losing your stake. It is therefore recommended to practice first by means of a free demo. By using a demo, you discover whether trading in Bitcoins is right is for you.

This post is also available in: English Nederlands Español Čeština polski Română Svenska Italiano Deutsch العربية עברית Português Русский Dansk فارسی Norsk bokmål Français 简体中文 繁體中文