The oil price is very volatile. This is because oil is the driving force behind our economy. Without oil planes stop flying, machines stop running and factories stop producing goods. It is therefore not surprising that there is a worldwide battle for this raw material. On Plus500 you can trade in oil yourself by using CFDs. In this article we will explain how you can trade oil by using the Plus500 trading platform.

How can you trade oil using Plus500?

With Plus500 you trade in oil by using a CFD. A CFD is a contract with which you can closely follow the price developments of oil. With a CFD you can open positions on both price increases and price decreases. This allows you to enjoy maximum flexibility with this trading instrument.

Do you want to try trading in oil with CFDs yourself? Open a free demo account on Plus500 and start immediately with your first oil trade:

[button title=”plus500 register” size=”large” nofollow=”1″ url=”/go/plus50011″ target=”_blank”]

After opening an account, you can immediately make your first oil trade. You can find oil by searching for oil or by navigating to commodities within the WebTrader. When you have found oil you immediately see that you have two trading options:

- Long: you will speculate on an increase in the oil price

- Short: you will speculate on an decrease of the oil price

After you have made a choice, a screen opens in which you can indicate the details of your order. Here you can choose on how many oil barrels you want to open a trading position. There is minimum number of barrels in which you can trade with Plus500. You can enter the following data within the order screen:

- Close at profit: you automatically close the position at a certain profit.

- Close at loss: You automatically close the position at a certain loss.

- Buy/Sell on: you automatically open a position at a certain oil price.

Oil CFDs

You cannot buy oil directly with Plus500. It is would also not be very elegant: hundreds of barrels of oil on your balcony. Oil trading is therefore done with derivatives. On Plus500 you trade in the price of oil by using a CFD. A CFD is a type of derivative that allows you to speculate on price increases and price drops.

A big advantage of CFDs is the fact that you can apply leverage. By using leverage, you can take a larger position with a smaller amount of money. The maximum leverage for oil is 1:10. When you apply a leverage of 1:10 you can open a position with a value of $10,000 with an initial deposit of $1,000. When you use a leverage of 1:10 this will have a significant impact on your trading results:

- Does oil rise by 10%? Then you double your investment.

- Does oil drop 10%? Then you lose the full stake.

Trading with leverage is therefore much more risky. At the same time, you can achieve a good result with smaller amounts.

How does trading oil at Plus500 work?

When you buy and sell oil CFDs at Plus500 this does not mean that you directly trade in oil barrels. When you trade at Plus500, you trade in oil supply contracts. With a supply contract or future the oil would normally be delivered at the expiry date of the contract. Fortunately, this is not the case with Plus500.

When the term of the contract expires, it automatically rolls over to a new contract. Any differences in the price of the new contract are automatically settled. At Plus500 rolling over to a new position does not influence your trading result.

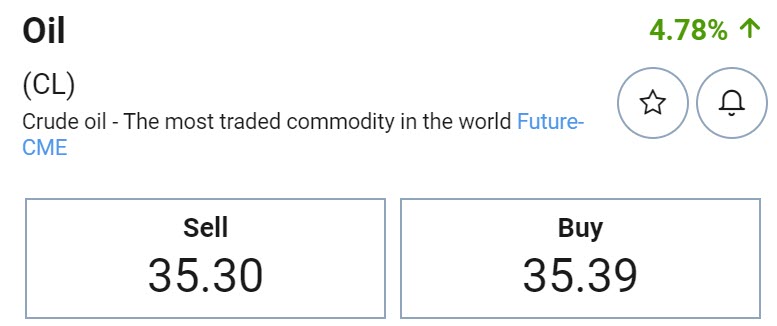

illustrative prices.

Trading in oil: what should you pay attention to?

Demand for oil often rises sharply when the economy is doing well. The demand for oil increases when people take the plane more often and when more buildings are built. When you start trading in oil, it is therefore wise to analyze the economic situation.

The supply side also determines the price of oil. The OPEC countries have a lot of power and determine how much oil is sold. When they suddenly deliver more than necessary, the price can collapse. This happened for example during the 2020 corona crisis.

When trading in oil, it is important to remember that you are trading in a commodity. Remember which parties influence the price of the commodity and analyze how they influence the price. By using the free demo, you make sure that you can properly practice trading oil first.

Within the Plus500 platform it is also possible to trade in CFD oil shares. This is an indirect way of trading in oil. For example, you can trade in CFD shares on Shell. Shell is a large Dutch company that deals with the entire oil production line. Other international CFD oil shares are also freely tradable on Plus500. In the article about trading shares on Plus500 you will learn more about this method of trading.

For the real daredevils there is also the possibility to trade with options on oil by using CFDs. Options move faster than the raw material itself because there is already leverage in the product itself. It is therefore important to be extra careful when you start trading in oil options!

The current oil price

Below you can see the current oil price on Plus500. With the buttons you can directly open a CFD position on this resource:

This post is also available in: