If you want to actively trade in CFDs on stocks, commodities, cryptos (Instrument availability subject to regulations) and Forex, both Plus500 and eToro are popular choices. In this extensive comparison, we look at which broker is best to choose: eToro or Plus500.

Do you want to try these brokers for free?

Before you start trading, you can try both brokers for free with an unlimited demo. This makes it possible to compare the different functionalities yourself:

eToro and Plus500 software

Both companies offer a WebTrader. With the web trader you can open CFD positions on various stocks and currency pairs via the internet.

Below you can see the trading platform of Plus500

Illustrative prices.

Within the Plus500 software you can find the asset in which you want to trade. Plus500’s software excels in user-friendliness. It is also useful that you can perform all kinds of technical analyses on the graphs.

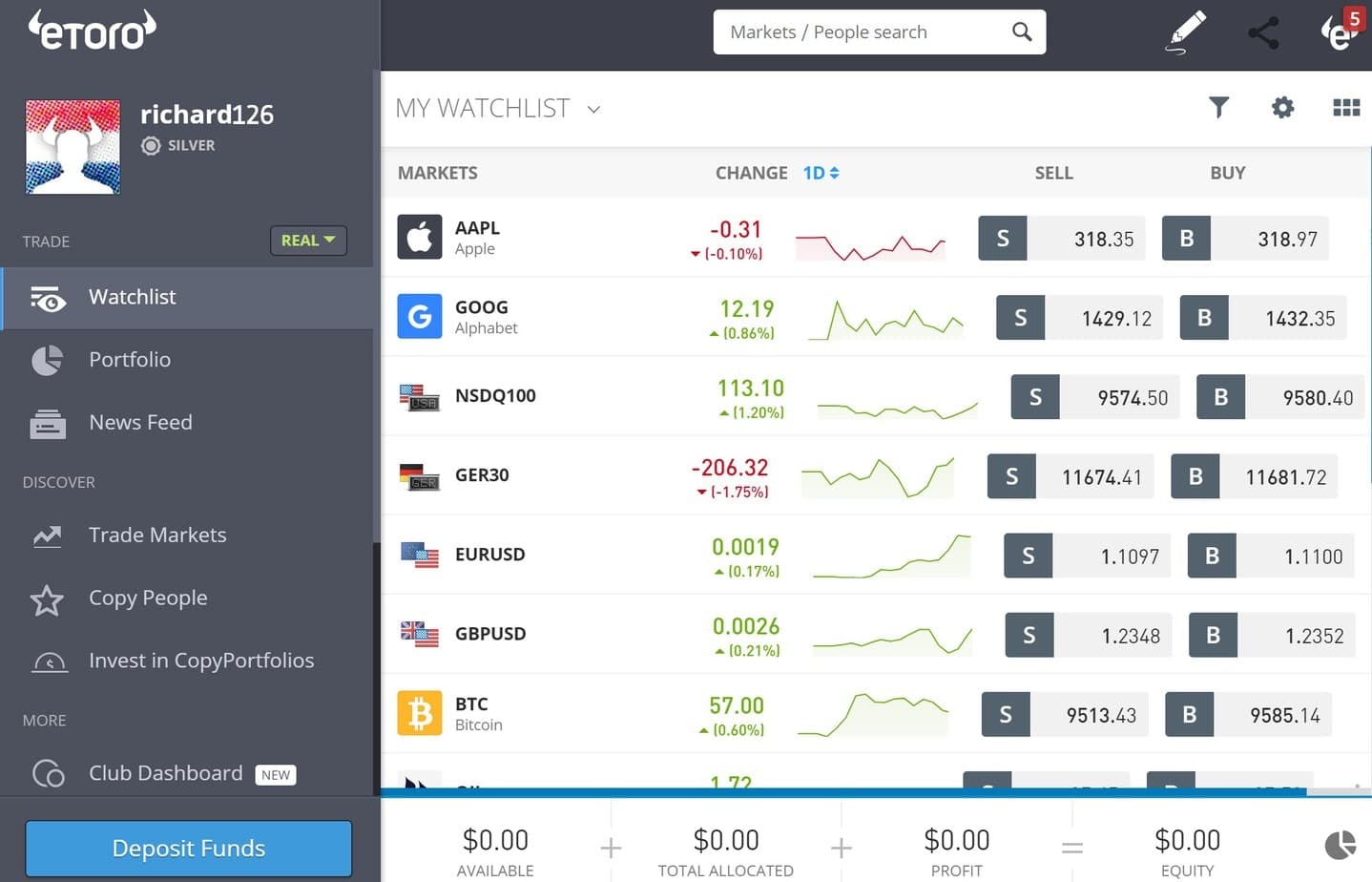

Below you can see the eToro trading platform

Illustrative prices.

Compared to the Plus500 trading platform, eToro’s platform is somewhat more confusing. This is because you can use all kinds of extra functions on eToro. If you want to discuss trades with other traders, eToro may be the better choice. If you prefer a clear and innovative, the Plus500 platform may be the better choice.

Additional features

With Plus500 you can only do one thing: actively trade in CFDs. On eToro you can use the necessary extra features.

You can trade socially on eToro. You can discuss market developments with other investors within the eToro platform. It is also possible to follow other investors. When you do this, you automatically open the trades they open in your account.

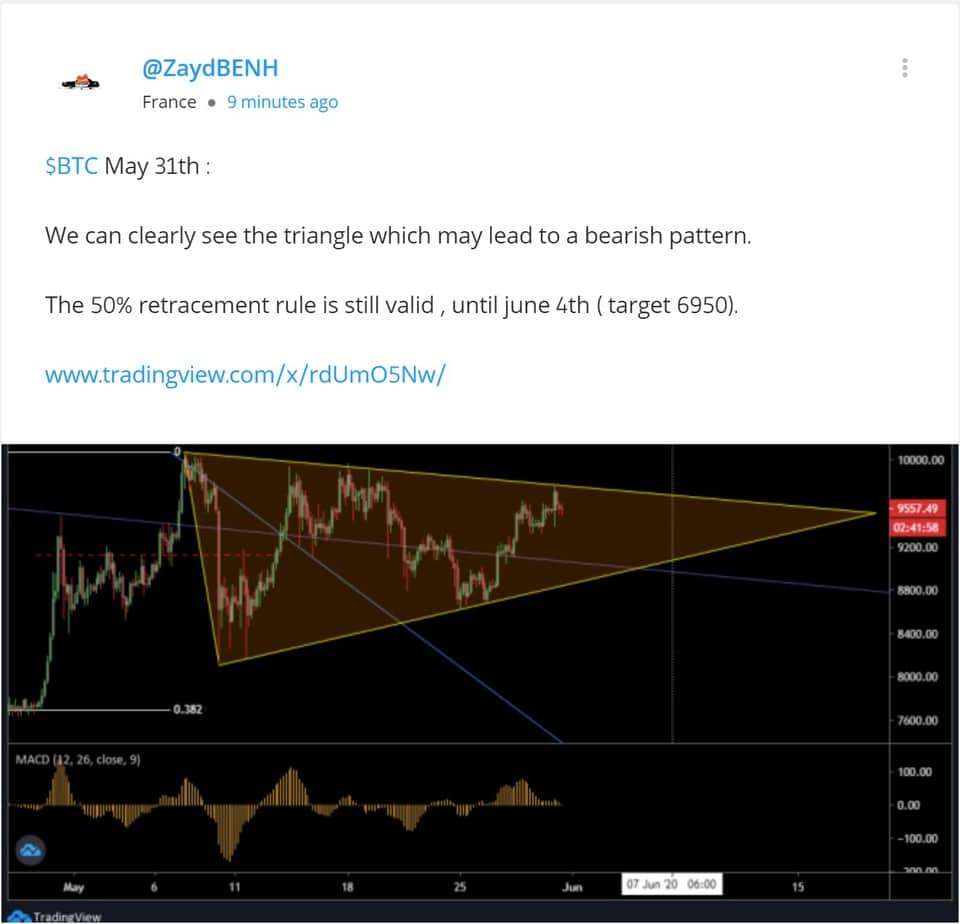

You can also follow portfolios on the eToro platform and read more extensive analyses. eToro therefore offers a few more features than Plus500. At Plus500, however, the graphs are better elaborated: you can apply all kinds of technical indicators to them.

If you are looking for a broker to trade actively, Plus500 is a good choice. If you are looking for background information, then you better go for eToro. It can of course also be attractive to use both brokers side by side.

Costs Plus500 versus eToro

Another important consideration when selecting a broker is of course the cost. We have compared the fees of Plus500 and eToro on the 2th of June 14:00.

Many people want to trade Bitcoin on Plus500 or eToro. At the time of writing, the spread on Bitcoin for eToro is 0.75% of the purchase value. At a Bitcoin price of $7,500, this equates to about $56. At Plus500 there is currently a fixed spread of $36. When the Bitcoin price falls sharply, the costs at eToro can be lower. At the moment, however, Plus500 is the economical option.

The EUR/USD is also widely traded. At the time of writing, the dynamic spread on Plus500 is $0.00006. On eToro, the typical spread is 0.0003. Plus500 therefore appears to be the advantageous option for trading in euro dollars.

On the Tesla share, the spread on Plus500 is $0.95 and on eToro $0.87. The spread for this CFD share is therefore close to each other.

Overall, the transaction fees on Plus500 and eToro are roughly the same. However, you have the advantage that you can invest in real shares and cryptocurrencies without commissions on eToro. When you use Plus500 you can only trade in CFDs.(Instrument availability subject to regulations).

One drawback to eToro is that you have to pay a withdrawal fee: $5 at the time of writing. This makes eToro less suitable for trading with small amounts. When you actively trade, it can pay to open an account with both brokers. That way you can always choose the cheapest rate for each individual trade.

Do you want to know more about the cost structure at Plus500? Read the article trading costs on Plus500.

Conclusion: Plus500 versus eToro, which one is better?

Both Plus500 and eToro are powerful and popular CFD brokers. If you’re looking for a wider range of options, eToro may be a better choice. Social trading and the ability to physically buy shares and cryptos without commissions are major benefits.

However, Plus500’s software is more user-friendly and costs are usually lower. Plus500 is therefore a good option if you want to actively speculate yourself. Since both brokers are so similair, it is advisable to open a free demo with both brokers.