Forex trading is also known as trading the foreign exchange market. When you trade Forex, you trade the value of currencies against each other. For example, you buy euros and sell dollars. In this article you can read everything about trading in Forex with the trading platform Plus500.

How to trade Forex on Plus500?

Before you can trade in Forex at Plus500, you must first open a free demo account. With Plus500 you can trade CFDs on stocks, currencies, commodities and indices. You can try the possibilities 100% without risk and without costs with the unlimited demo. Use the button below to create an account:

[button title=”plus500 register” size=”large” nofollow=”1″ url=”/go/plus50010″ target=”_blank”]

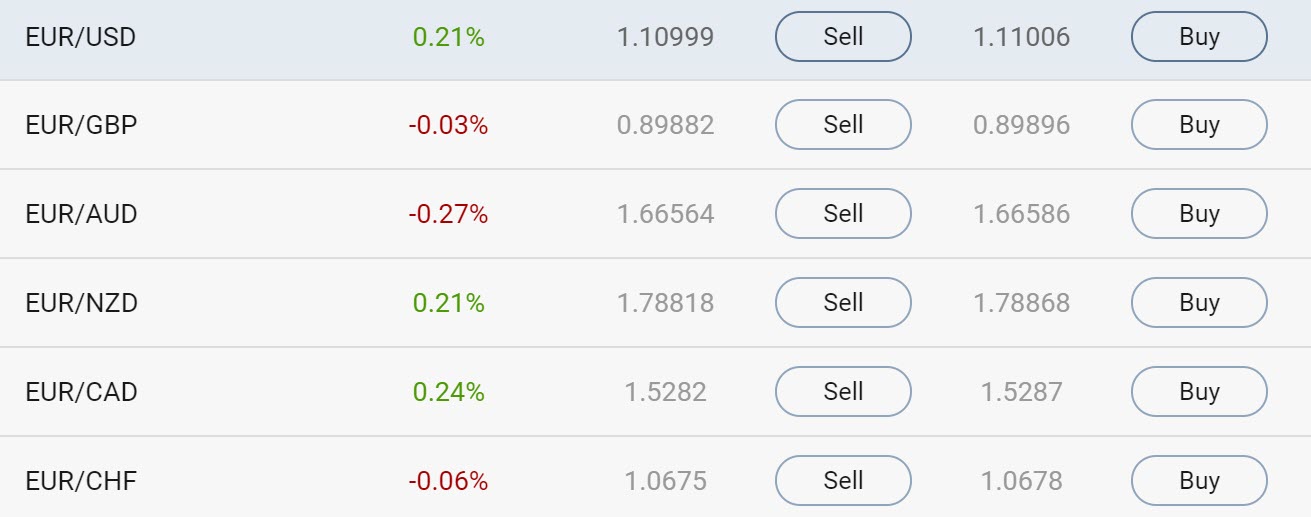

You can then trade Forex by pressing Forex (category). Here you see an overview of all currency pairs in which you can trade on Plus500.

illustrative prices.

How does trading Forex work?

When you trade Forex, you always trade in a relative ratio. After all, a single currency cannot have any value. For example, you trade in the value of the euro against the dollar or in the value of the pound against the euro. When you start trading in a currency pair, you will see it noted as follows: EUR / USD.

When you trade in EUR / USD you invest in the value of one euro against a dollar. You can open two types of Forex trades:

- Buy: you achieve a positive return when the euro becomes more valuable against the dollar

- Sell: you achieve a positive return when the euro becomes less valuable against the dollar

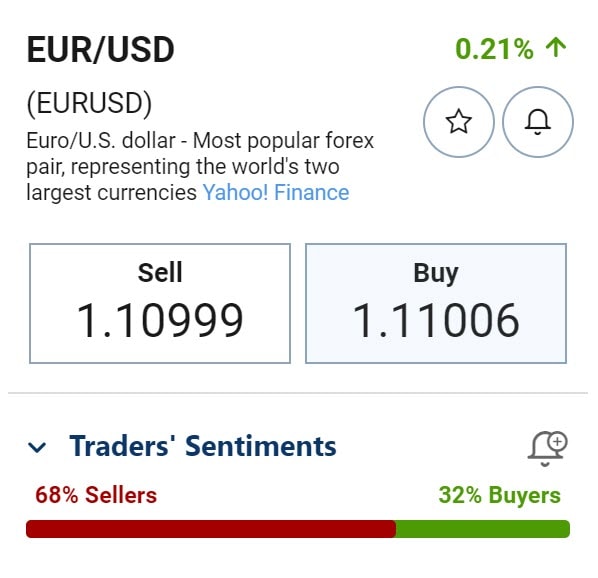

You can open a position on A forex pair by pressing the buy or the sell button next to the pair. After you press one of the buttons the following order screen opens:

illustrative prices.

In the order screen you determine the amount with which you want to trade. For example, you can open a position on EUR / USD for $1000. When the euro becomes more valuable, you achieve a positive investment result and when the euro becomes less valuable, you lose money.

You can also protect your positions in the order screen. You do this by setting a stop loss. A stop loss is a level at which you automatically take your loss.

illustrative prices.

Trading with leverage

You can trade currencies on Plus500 through leverage. Leverage makes it possible to take a larger position with a small amount. The maximum leverage on currency pairs is 1:30. This means that with an amount of $1000 you can take a position of $30.000. Using leverage has a strong effect on your results. Let’s explain this with an example.

Without leverage you achieve a positive result of $10 with a position of $1000 when the EUR / USD exchange rate increases by one percent. When you apply a leverage of 1:30, the positive result increases to $300. So your returns move 30 times faster! Obviously, the same goes for your losses.

With a leverage you can therefore increase both the potential for gaining profits and losses.

How is the price of a currency determined?

The value of a currency depends on the supply and demand of the currency. However, the global foreign exchange markets are huge and the number of people buying and selling currencies is large. When you buy an ice cream in a foreign currency on holiday, you are already responsible for the constant flow of money.

A tourist who buys an ice cream is of course not the most important player on the Forex market. There are some parties that can greatly influence the price of a currency. Central banks have a lot of power and strongly influence the price of currencies. They can raise interest rates which can make a currency more attractive. When more people buy that currency, the exchange rate of that currency will rise against other currencies.

Economic data is also very important. If the economy is doing very well in a region it can attract investments. When Europe is in a slump and America is doing very well economically, there will be more companies that need dollars. It may then happen that the value of the euro drops against the dollar.

The strongest price movements on currency pairs can be seen in unexpected events. Investors always look ahead and when traders know that the interest is going up or down, this is often already passed on in the price. Do investors think interest rates are going up, but are they going down? Then you can expect a significant market movement.

It can therefore be interesting to trade Forex in uncertain times. During Brexit, for example, it was interesting to keep an eye on the exchange rate of the British Pound.

What are the most important Forex terms?

- Pip: the smallest amount a currency pair can move, this can be 0.00001

- Spread: the difference between the buy- and sell price of a currency pair

- Leverage: makes it possible to trade with a higher amount

- Exchange rate: the value of a base currency versus the quote currency

- Bid price: the price at which the broker wants to buy the currency pair

- Asking price: the price at which the broker wants to sell the currency pair

What are the most popular currencies?

The most popular Forex pair is EUR/USD. This is the most liquid currency pair and a good place to start trading Forex. The EUR / USD moves in relatively predictable patterns, allowing you to get in at the right times based on technical analysis.

Another popular currency pair for investments is GBP/USD. Under the influence of Brexit, we have seen more volatility on this currency pair. When you start investing in GBP/USD you need a bit more experience.

The USD/JPY currency pair is also very popular. After the EUR/USD, this is the most traded currency pair. Japan has a central role in the global economy and the exchange rate of the Japanese Yen is often indicating of the economic situation in the entire Asian region. Trading USD/JPY on Plus500 can also be interesting.

When you start trading with Plus500, it is wise to first keep a close eye on one currency pair. That way you will become familiar with the patterns within the pair and you can get better results. It is advisable to first practice with a free demo to discover whether Forex trading is for you.

How can you analyse Forex?

Many people do day trading on Forex. When you do day trading, you try to predict the exchange rate of currencies using analyses. You can do this entirely through fundamental analysis. When you use fundamental analysis, you research whether a currency is undervalued and whether there is a high chance that the currency will become more valuable in the future.

Another interesting analysis that you can apply is technical analysis. Within the Plus500 software you can add technical indicators to your graph. The indicators can help you make the right trading decisions.

You can investigate whether a currency is undervalued and whether there is a high chance that the currency will become more valuable in the future.

Another interesting analysis that you can apply is technical analysis. Within the Plus500 software you can add technical indicators to your graph. The indicators can help you make the right investment decisions.

You can draw horizontal levels on the graph. Horizontal levels are levels that the price regularly hits, but does not break through. You can also recognize patterns with indicators such as the RSI (relative strength index) and moving averages. Finally, you can learn how candlesticks work. In the Plus500 tutorial you will learn more about using candlesticks.

Which events influence the Forex price?

When you start trading in Forex you need to be careful when the following numbers are released:

- Interest: Higher interest rates can increase the value of a currency.

- Inflation: low inflation can cause central banks to cut interest rates. This can weaken the currency.

- Employment rates: When employment numbers in a region are strong, the currency there may strengthen.

- Sentiment questionnaires: discover how consumers think about developments within a region.

- GDP: When a country or region produces more, the demand for its associated currency may increase.

How much does Forex trading cost on Plus500?

Plus500 is one of the most advantageous brokers for Forex trading. On Plus500 you pay a spread when you open a position. The spread is often minimal, such as 0.00002. You then multiply this spread by the amount of currency you trade with.

However, you should take into account that you pay a small financing interest on positions that you keep open for a long time. The broker funds a large part of your trade when you trade Forex using CFDs. How much interest you pay (or sometimes receive on short positions) can be found in the information of each currency pair.

illustrative prices.